Are large online businesses paying their fair share of tax? This was the question debated on Tuesday 27 March by MPs in Westminster Hall, the small debating chamber in Parliament.

Will Theresa May be able to deliver her ambitious plans for data protection after Brexit?

Written by Inline Policy on 16 Mar 2018

Prime Minister Theresa May put data protection at the heart of the UK’s post-Brexit relationship with the EU when she delivered her latest set piece Brexit speech on 2 March.

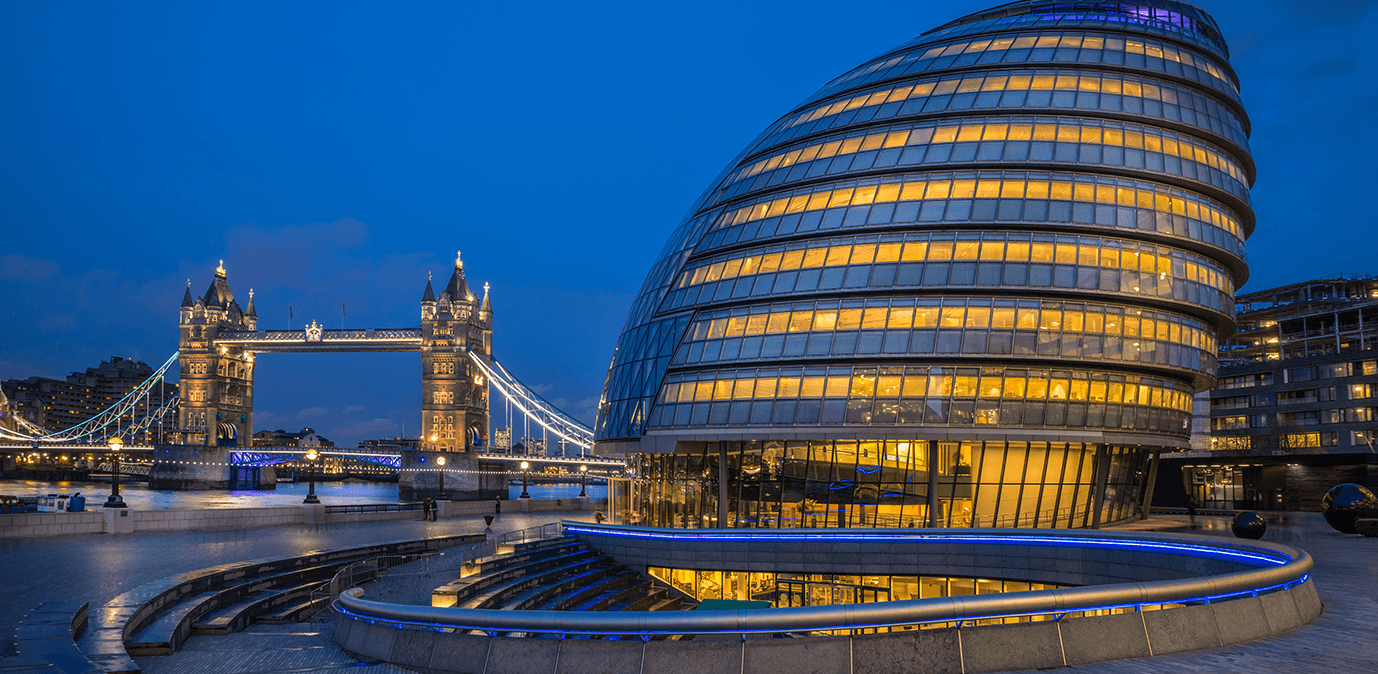

New Regulations Ahead: London’s Transport Committee Report on Future Transport

Written by Matthew Niblett on 13 Feb 2018

The London Assembly’s Transport Committee has today published ‘Future transport - How is London responding to technological innovation?’

What the UK Government's announcements mean for the Gig Economy

Written by Inline Policy on 08 Feb 2018

The UK Government has published its long-awaited response to the Taylor Review of Modern Working Practices.

Theresa May at Davos calls for international cooperation to regulate tech sector

Written by Inline Policy on 30 Jan 2018

Prime Minister Theresa May’s speech yesterday to the World Economic Forum in Davos saw her repeat calls for international action to regulate aspects of the tech sector that are disrupting the established economic players and norms.

European Bike-Sharing: how to move forward

Written by Inline Policy on 30 Nov 2017

Over the past six months, brightly coloured bikes have appeared across European cities as bike-sharing, and in particular dockless bike-sharing, has featured with ever growing prominence in public debates. sharing.

Dockless Bike-Sharing: the next regulatory quagmire

Written by Inline Policy on 15 Aug 2017

This summer, Londoners will have noticed the addition of new bicycles parked in various locations across Britain’s capital. Closer inspection of these bikes reveals that they are ‘oBikes’ - a bicycle which you can unlock with an app on your phone and use at very little cost, without the need to park at docking stations.

What does the Industrial Strategy say about a low carbon strategy in the UK?

Written by Inline Policy on 09 Feb 2017

To a rather muted fanfare, the British Government published its industrial strategy green paper last month. As far as the energy and climate change audience were concerned, in the run-up to the publication of the strategy, the Business Energy and Industrial Strategy Department (BEIS) – a department still in its infancy - was essentially facing two challenges:

Full steam ahead for the EU in 2017 on Banking Regulation and Capital Markets Union

Written by Inline Policy on 19 Dec 2016

2017 is set to be a year of acceleration in the pace of regulation of the financial services sector at global and European levels. The Basel Committee on Banking Supervision (BCBS) is making steady progress on plans including a leverage ratio surcharge for global systemically important institutions (G-SIIs).

Does the global aviation emissions agreement sustain the momentum of the Paris agreement? Or does it detract from it?

Written by Inline Policy on 20 Oct 2016

On 6 October, a new acronym was introduced to the world of aviation and climate change. CORSIA – the Carbon Offset and Reduction Scheme for International Aviation – is the outcome of what many in the aviation industry have described as an “historic agreement” to tackle the burgeoning problem of aviation emissions.

Crowdfunding: Maturing with Regulation

Written by Inline Policy on 01 Sep 2016

In July, the Financial Conduct Authority (FCA) – the body that regulates loan-based and investment-based crowdfunding in the UK – launched a ‘call for input’ on the current rules applied to crowdfunding in the UK.

eSports gambling – regulators take a closer look

Written by Inline Policy on 24 Aug 2016

The prospect of video gamers becoming paid professionals, and people placing bets on the outcome of contests, would have seemed unthinkable a few years ago.

Energy storage technologies – will they be able to flourish within current regulatory frameworks?

Written by Inline Policy on 03 Aug 2016

The concept of energy storage is not new. However, technology advancements and the increased sense of urgency in relation to decarbonisation have gradually drawn attention to the possibilities of storage.

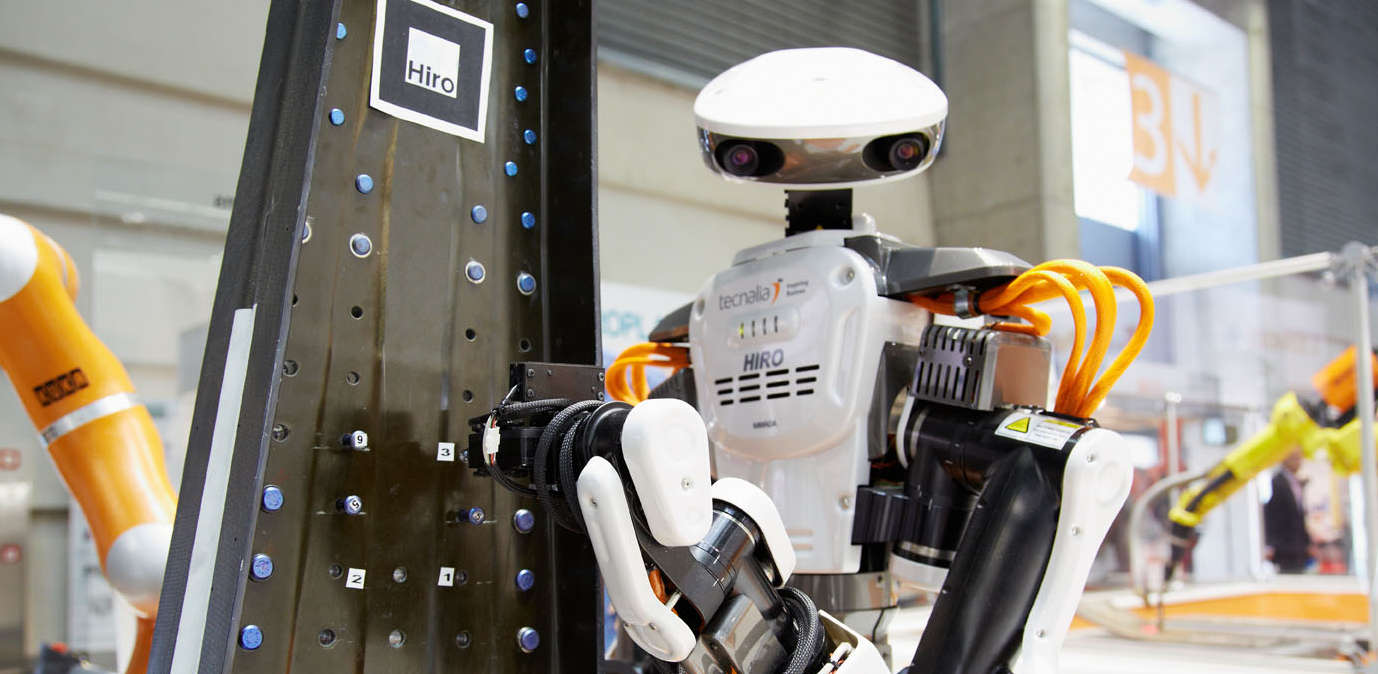

Robots and liability issues: the future regulatory framework

Written by Inline Policy on 30 Jun 2016

Robots are rapidly gaining public visibility as their development accelerates in conjunction with recent innovations in the domains of artificial intelligence, machine learning, machine-to-machine and machine-to-human interaction.

Brexit - Implications, what happens next and business considerations

Written by Inline Policy on 27 Jun 2016

Events have moved very quickly over the weekend, and the timeline for events post the UK referendum on the EU is becoming clearer, if not yet the future scope of UK-EU relations or the eventual implications for politics, economy and business.

Insights from Inline Policy listing page

Insights from Inline Policy listing page