The changing nature of the labour market is a consistent feature across many countries, including the UK, which has long prided itself on its flexible labour market.

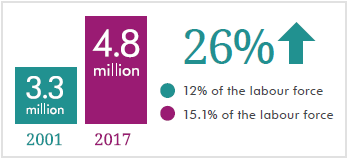

In recent years, the Office for National Statistics (ONS) has identified a pronounced increase in the number of the self-employed, from 3.3 million people (or 12.0% of the labour force) in 2001 to 4.8 million (or 15.1% of the labour force) in 2017.

Thus, the proportion of the UK workforce that is self-employed has increased by 26% since 2001, while the actual number of self-employed workers has risen by 45% in that time.

It is important to note that the self-employed are not a homogenous entity. There are marked differences in the experiences of those entrepreneurs who run their own business and those performing so-called ‘gig’ work, whether that be regularly for a single work provider or sporadically for several.

But over the past few years, both groups have increased in number in the UK. LinkedIn, for instance, has identified that in a single year between 2016 and 2017 the number of entrepreneurs increased by over 6%. This tallies with the trend identified by the Department for Business, Energy and Industrial Strategy (BEIS), which found that the number of SMEs in the UK rose between 2000 and 2013, from 3.5m to 4.9m. By 2017, moreover, there were 5.5m micro-businesses in the UK, representative of 96% of total businesses.

Likewise, research from the NatCen Panel for BEIS found that 4.4% of the population in Great Britain had worked in the gig economy in the last 12 months, which equates to roughly 2.8 million people.

The growth outlook is strong and more and more people are set to perform some kind of gig work in the years to come.

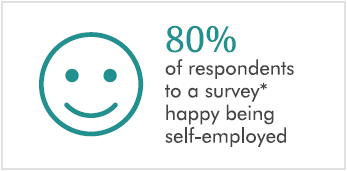

Despite claims to the contrary, there is evidence that the majority of the self-employed choose to be so. Polling carried out by Demos for its ‘Free Radicals’ report found, for example, that 80% of respondents reported that they were happy being self-employed, and 70% intended to be self-employed for the foreseeable future.

In a similar vein, research by the RSA found that 63% of gig economy workers agreed that the style of work provided more freedom and control.

None of this is to say that all facets of self-employment should be nurtured or celebrated, but it does suggest that flexible, independent working has become rather popular among certain groups in society and is here to stay. All the more so, given modern technology’s latest advances.

*According to polling carried out by Demos

Subscribe to Inline Policy's weekly Sector News Summaries for indispensable round-ups of all the latest regulatory and market news from around the world for four of the key technology sectors.

The infiltration of tech into our everyday life is no longer a new phenomenon but a development that has profound implications for how we behave and relate to others. It affects the way which work is provided and offered, and nowhere is this more evident than in a gig economy driven by digital platforms emerging from nearly every corner of the world.

In a survey carried out by Regus, over half (54%) of global respondents stated that they work outside their main office 2.5 days a week or more; in the UK the figure was over 45%. The definition and conception of the workplace is indeed changing fast.

Much in the same way that work is now increasingly provided or carried out via technology, so too is tech increasingly used to underpin service provision, with governments around the world working to digitise many of their processes. In the UK, for example, HM Revenue & Customs has invested considerably in its Making Tax Digital programme, a new online system to help individuals and businesses to keep on top of their tax affairs.

Does this point to a future in which independent, tech-enabled working becomes simply irresistible for us all? Not quite, or at least not as long as the self-employed and flexible workers remain short-changed on benefits and protections. Historically, the protections and benefits that provide a safety net for the UK workforce have been mediated through the employer-employee relationship: for instance, the employer pays contributions towards National Insurance (NI) and pensions; some work places offer health programmes; others provide the chance to upskill.

However, this provision is predicated on a formal, contractual relationship between the employer and employee, usually based on regular hours of work, in a time and place stated by the employer. With more people opting for gig or independent work, fewer people are captured by this structure, and are thus missing out on the safety net enjoyed by those of worker or employee status.

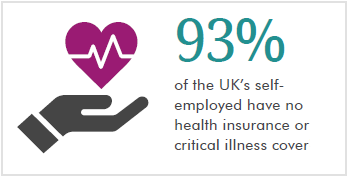

The statistics bear this out: 93% of the UK’s self-employed have no health insurance or critical illness cover.

But while not all employees have health insurance, pensions are much more ubiquitous and here we can also see a gap: in February 2018, the Office for National Statistics revealed that 45% of self-employed workers aged between 35 and 55 have no private pension, compared to 16% of those that are employed. Similarly, amongst those aged over 55, 30% of self-employed workers have no private pension compared to 14% of employees.

Perhaps even more striking than this disparity between the self-employed and the employed is the ONS’ finding that there has been a drop over the last decade in the number of self-employed workers saving into a pension: while just 25% are contributing now, 40% were doing so in 2008.

Even if the self-employment model intrinsically means that the sorts of protections extended to workers and employees are not included in working arrangements, there are nonetheless significant numbers of people who are simply not protected from the vagaries of life. And this is against the background of a welfare state that is coming under increasing pressure.

WorkerTech: digital service offerings that harness the power and convenience of technology to provide independent and flexible workers with personalised benefits and greater access to protections and rights.

Now that the demand for better access to protections and benefits for the self-employed is matched by the technological wherewithal to deliver these to individuals, the conditions are right for the emergence of solutions that respond to that demand, using technology to do so: WorkerTech.

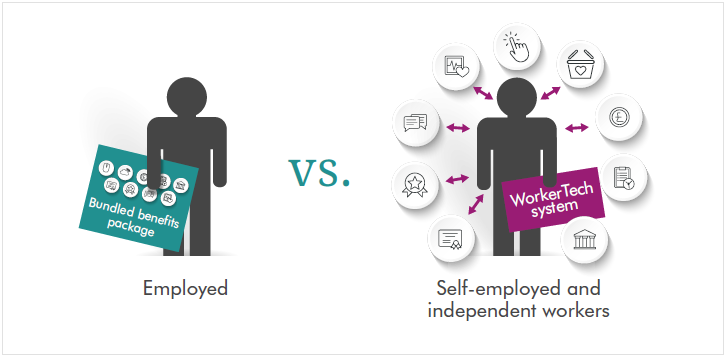

Whereas benefits and protections are delivered to employees or workers en bloc via the formalised relationship with their employer, the self-employed must procure their own protections, on a disaggregated basis.

Not for them an all-in-one package covering pensions, health and skills training; instead, they need a way of securing each benefit or protection, one by one.

The past few years have seen promising signs with the development of WorkerTech solutions. Start-ups have taken advantage of the clamour for the self-employed to be better protected by developing products that are specifically designed to support the self-employed and gig workers. Meanwhile, many big companies are cultivating services based on their own expertise that have particular application for the self-employed.

These same market solutions could even provide complementary services for those in employee or worker relationships, allowing them to procure services over and above those delivered by their employer. The individual is in a position to choose.

What unites many of the companies of all sizes that are developing WorkerTech solutions is the recognition that the method of provision really matters: services and protections delivered directly to the individual, via accessible technology.

WorkerTech encompasses a range of areas from on-demand insurance, to collective voice platforms, to portable benefits. Although the companies and organisations that make up the WorkerTech market are solving a wide range of problems, and thus employing differing approaches, there are some consistently identifiable features that they exhibit:

The following illustrates the issues to which WorkerTech applications offer a solution, and some of the initiatives and ideas that are emerging to support independent workers:

If you'd like a downloadable copy of the content on this page, all this information and more can be found in our new white paper.

An online, cloud-based learning management system, which has been used by gig economy platforms to deliver training to their drivers.

Provides online courses, taught by various prestigious universities and educational institutions. Courses include recorded video lectures, assignments and discussion forums.

Provides online courses, taught by various prestigious universities and educational institutions. Courses include recorded video lectures, assignments and discussion forums.

A smart business current account for freelancers and the self-employed, which helps to manage tax, stay on top of expenses and ensure getting paid on time.

As part of its Inclusive Futures Project, Mastercard has committed to partner with digital partners and government officials is to develop products and services for gig and on-demand workers. One of the three strands of project focuses on digital solutions to manage finances and speed payments.

A platform that offers workers the broadest range of ways to be paid, at the time most convenient to them.

NEST are part of a collaborative group including Prudential, Uber and the CBW Group, proposing an app named Giggle, that allows someone working for a number of gig employers to channel pension contributions through a single platform.

Aggregates data from across sharing economy platforms & social network profiles to determine a trustworthiness rating.

Allows users to amalgamate their digital reputation across sharing economy platforms.

Offers insurance to delivery drivers and private hire drivers for only the specific time that they are working, linked through the work platforms themselves.

On-demand insurance platform that offers insurance in chunks, allowing customers to buy insurance only when they need it.

Enables workers to launch or join campaigns to improve their jobs and workplaces.

Collates background information about work platforms, reviews from their workers, and assessments of their terms of services to give comprehensive reviews of the working conditions on different platforms.

Provides safety and health programmes for for-hire drivers, their passengers and New Yorkers on the road. This includes safe driving and first response training; worker compensation insurance; and driver death benefit.